Continuing pension problems have earned Illinois another reduction in its credit rating.

Continuing pension problems have earned Illinois another reduction in its credit rating.

Standard & Poor's Ratings Services announced Wednesday that it is lowering their rating on bonds issued by the state of Illinois from an A+ rating to an A rating. The cost of General Obligation bonds will now increase for taxpayers because of the lower A rating. S&P analysts noted that the rating was lowered due to “the state’s weak pension funding levels and lack of action on reform measures.”

So what does this lowered rating mean for taxpayers?

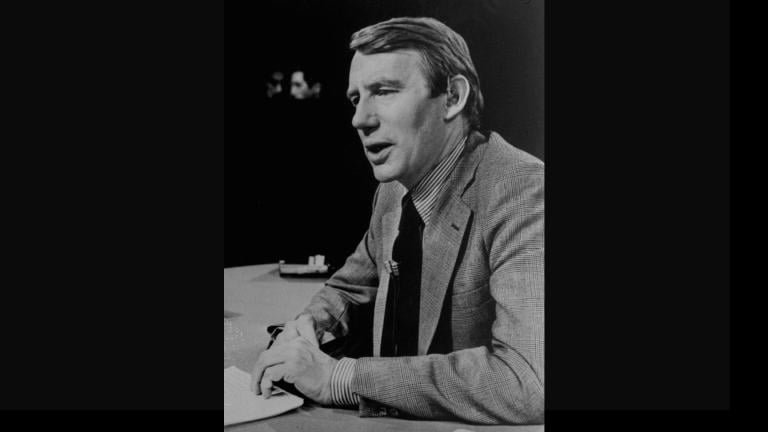

“Inexactly it’s going to cost more for the people of Illinois to borrow money than it used to,” said Brian Battle, Director of Trading at Performance Trust Capital Partners.

A lower bond rating essentially means that Illinois is less credit-worthy so it will cost taxpayers more to borrow. In exact terms, the lowered rating means capital markets will charge Illinois a higher rater than other states to borrow. The current cost being 150 basis points more than a solid Double A (AA) rated state like Maryland. Or to put that number in perspective, $1.5 million more per $100 million borrowed. What’s frustrating about this downgrade Battle explains, is that even though the state of California is tied with Illinois for last place in ratings, they’re only being charged 70 points.

“That’s half as much of a penalty as Illinois,” said Battle. “It’s discouraging because we were downgraded based on our management, S&P were clear on that.”

The state’s failure to address pension problems has put us on “negative credit watch,” meaning if the state continues to do nothing, we’ll be downgraded again.

The state’s failure to address pension problems has put us on “negative credit watch,” meaning if the state continues to do nothing, we’ll be downgraded again.

“Illinois is on a downward trajectory, it’s a downward slope, and we’re deemed to be twice as bad as California since our penalty is twice as big,” said Battle.

Battle says this is the least surprising headline and the most aggravating ever.

“The leadership in Springfield knew this would happen. They saw it coming and did nothing. They’re either negligent or indifferent, I’m not really sure which,” he said.

This leaves Illinois with really only two choices Battle continued, “either our taxes are going up or the level of services will decline.”

Springfield legislators were explicitly warned last time that the state would be downgraded if the problem wasn’t addressed.

“It can’t get any clearer than that, and they chose to ignore the warning. It’s a failure of leadership in Springfield. Someone should be calling the General Assembly to Springfield, lock the doors and turn off the air conditioning and let them figure it out,” said Battle.

If Illinois can’t find a solution, the consequences will be severe.

“It will kill the state, it will wreck the state,” said Battle.

A new report issued by State Budget Solutions Wednesday stated that Illinois’ total state debt is $271 billion, making it the fifth largest state debt in the country. This is compared with California, who may have the largest total state debt at $617 billion, but their per capita is only $16,386 compared to $21,067 in Illinois. Fiscal responsibility could help lower this per capita cost, taking a page from Tennessee where the debt burden is only $5,300 per person, or Nebraska where it’s the lowest at $4,200.

A new report issued by State Budget Solutions Wednesday stated that Illinois’ total state debt is $271 billion, making it the fifth largest state debt in the country. This is compared with California, who may have the largest total state debt at $617 billion, but their per capita is only $16,386 compared to $21,067 in Illinois. Fiscal responsibility could help lower this per capita cost, taking a page from Tennessee where the debt burden is only $5,300 per person, or Nebraska where it’s the lowest at $4,200.

According to a report by the Illinois Policy Institute, one person leaves Illinois on net every 10 minutes.

There is some shred of hope though. Illinois has a huge window of opportunity where the penalty we pay will not be so painful because all interest rates are at an all-time low.

“Once the interest rates rise, we’re going to get crushed. The numbers will get gigantic,’’ said Battle.

Legislators demonstrated their inability to reach a conclusion on pension reform in the special session held last week.

Battle’s greatest fear is that Illinois will be downgraded again in January if a decision is not reached.

“I think what’s important for taxpayers to understand is that this is our money. It seems nebulous with points and millions and billions of dollars, but what’s happening is that the budget will crowd out services,” said Battle. “People will have to pay more to live in Illinois and services will go down. If that doesn’t animate the voter base, I don’t know what will.”

Paris Schutz, at the Republican National Convention in Tampa, asked Illinois House Minority Leader Tom Cross (R-Oswego) whether the downgrade would be enough to prompt pension reform before the elections. Watch his response:

Illinois State Treasurer Dan Rutherford reacted to S&P’s downgrade of Illinois debt in a statement released Wednesday saying:

“Just as I said last week, after we received a sobering warning from Moody’s, I urge the legislature to act decisively towards comprehensive, constitutional, and fair pension reforms that will reverse this situation. It’s not even two years since the largest income tax increase in Illinois history, and those revenues have already been consumed by the escalating cost of the state’s pension systems. Taxpayers are justifiably frustrated and angry over Springfield’s lack of action to protect their dollars.”

Related Links: