The Better Government Association reports that some Illinois municipalities struggling with high debt loads and troubled budgets could be looking at bankruptcy as an option to get out of a financial hole -- even though it's technically illegal. Andrew Schroedter and Patrick Rehkamp from the BGA, Rockford Mayor Larry Morrissey and James McNamee, president of the Illinois Public Pension Fund Association, will join us to discuss the implications.

Read an interview with James E. Spiotto, managing director of Chapman Strategic Advisors LLC. Spiotto has experience representing issuers, indenture trustees or bondholders in litigation, bankruptcy, or workouts of more than 400 troubled debt financings in more than 35 different states. Last month, he wrote Lessons Learned from Detroit’s Bankruptcy for MuniNetGuide.com, a website that Spiotto co-owns and co-publishes that specializes in municipal-related research and information.

Read an interview with James E. Spiotto, managing director of Chapman Strategic Advisors LLC. Spiotto has experience representing issuers, indenture trustees or bondholders in litigation, bankruptcy, or workouts of more than 400 troubled debt financings in more than 35 different states. Last month, he wrote Lessons Learned from Detroit’s Bankruptcy for MuniNetGuide.com, a website that Spiotto co-owns and co-publishes that specializes in municipal-related research and information.

What is Chapter 9 Bankruptcy?

Chapter 9 bankruptcy is a process, a legal proceeding where a municipality—which could be a city, town, utility district—some instrumentality of a state, not the state itself, is specifically authorized under state law [to file for bankruptcy]. States cannot file for Chapter 9. It provides a mechanism to adjust debt, so a municipality can continue to provide services and benefits to its residents… It doesn’t liquidate anything. It’s a process.

Why can’t the state of Illinois file for Chapter 9?

The state can’t file because we sort of forget this: the state and the federal government are co-sovereign governments. A federal court could not sit in judgment of a co-sovereign bankruptcy. But a state could allow its agencies and instrumentalities, which are under it, to be subject to a federal court, with its permission, which is why Chapter 9 has to be specifically authorized.

What is the process for a municipality to file for Chapter 9?

Some states have specifically authorized general filing of Chapter 9. [There are 12 states] that specifically authorize Chapter 9. Another 12 [states] conditionally authorize municipalities to file, which means they need permission from the governor, treasurer, or legislature to file. Three states—and Illinois is one of them—have a particular government agency that gives permission. In Illinois, it’s the Illinois Power Authority; nobody else does because it was put in the legislation. Two states prohibit it, and that’s Iowa and Georgia. And the remainder has not specifically authorized it.

What are the usual types of municipalities that file for Chapter 9?

Most of them are small special tax districts and utilities because it’s a graceful way to end ... If a utility outlived its usefulness, it’s a graceful or a peaceful end to adjust the debt to what is payable and stop providing services because some other entity has taken over a service.

Can you give an example?

An electric utility is in an area next to a city. The city expands and takes over the area, [and] basically, the electric utility loses its customers and rate base, and goes to Chapter 9 to adjust its debt to what it can pay off. Another example, a small utility just incurred something larger than it can handle. Then, for the sake of being able to provide services, its debt gets adjusted so it can continue to provide services to people. .. A larger utility or enterprise has more staying power, so to speak, because it has a larger rate base, more revenues. If you have a $1 million judgment, and you’re a small utility, that’s catastrophic. If you are [utility] with a $500 million revenue base, you can work that out.

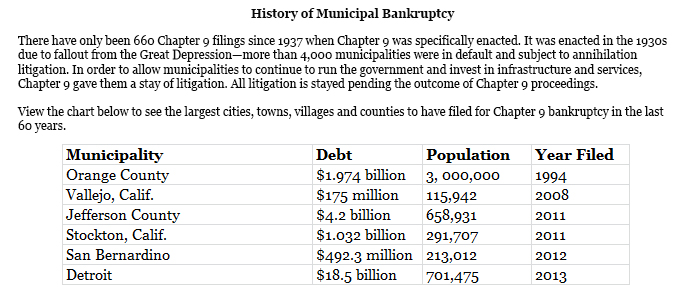

More than 60 percent of Chapter 9 filings have been filed by special tax districts and utilities. About 18 percent are cities, towns, villages, and counties—what you usually think of when you think of a municipality. And then you have about 16 percent that have been hospitals and health care facilities. And just a fraction has been schools or transportation.

If a municipality were to file for bankruptcy, would that be their “golden ticket” to turning around their situation? What other steps would need to be taken?

Chapter 9 is a process, a process to adjust debt to what is sustainable and affordable. Once you reach that, it gives you more runway, so to speak, to do a recovery plan. And that means how you reinvest in the municipality, its services and infrastructure to stimulate the economy, encourage businesses to grow there, encourage other businesses to come in, create new jobs, especially for younger workers. That creates increased tax revenues, which is your recovery.

It’s always important for municipalities to realize, as Detroit now realizes, to have investment in the city. You have to stimulate the economy. You have to have a recovery plan that works. Chapter 9 is just a process. A recovery plan brings a solution.

Legislation has been introduced to make a clearer path to Chapter 9 in Illinois. What are your thoughts about legislation making it easier for state municipalities to file for Chapter 9?

Up until now, Chapter 9 was viewed as a last resort, even I believe Detroit, Stockton, San Bernardino and Jefferson County that have all been in it, viewed it as a last resort. It’s time-consuming. It’s expensive. It’s uncertain and you may not necessarily like the results. You only do it when you absolutely have to when all other alternatives don’t work. The issue for any state is whether or not it’s necessary for municipalities. Can they solve it otherwise? Can they get to a recovery plan without going through Chapter 9?

Most big cities do not file for Chapter 9. Up until Detroit, the largest city of a state never filed for Chapter 9. Since July 2013, no other city, town, county or village has filed for Chapter 9. You had special tax districts and utilities and hospitals [file].

What do you think about that?

It’s a normal thing. I think it’s an outgrowth of what we saw happened in Detroit. People saw the controversy, the issues, the pain and suffering. In fact they’re still having it. They’re still in the implementation of the recovery plan. They just adjusted the debt. But you really need to have a recovery plan. [Because of Detroit,] municipalities realized they should be addressing issues earlier and should be reinvesting in the city, services and infrastructure so they stimulate the economy and do things to avoid an economic downturn.

What are some resources or programs that can provide cash-strapped state municipalities assistance outside of bankruptcy?

There’s the ability to borrow money if a municipality is distressed from the Illinois Finance Authority, and there’s also the ability to request, as they did in Philadelphia, to transfer certain services. You may want to talk in terms of fire and police or solid waste collection… Transfer [those] to a more regional basis or combine with other municipalities, lowering the cost of administration and service. Some may consider municipalities being annexed to another municipality, which hopefully has the wherewithal to deal those problems. There’s a number of ways to deal with it. Generally, in the past, municipalities worked with creditors to come up with an approach that’s fair to all and allows them to make payments , all while keeping in mind to make sure to keep on investing and maintaining services for citizens and infrastructure for the municipality to survive and thrive.

Interview has been condensed and edited.