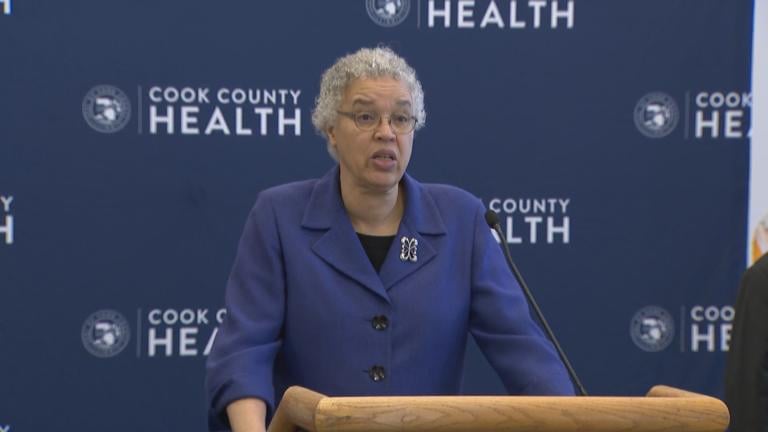

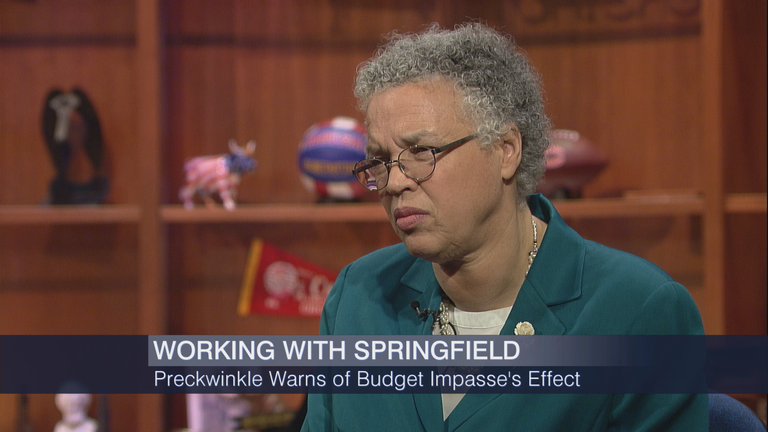

Cook County Commissioners approved Wednesday a 1-percent increase in the county portion of the sales tax, which brings Chicago’s sales tax to 10.25 percent. President Toni Preckwinkle’s proposed penny-on-the-dollar sales tax was approved by a vote of 9-7, with Commissioner Liz Doody Gorman casting a present vote.

Cook County Commissioners approved Wednesday a 1-percent increase in the county portion of the sales tax, which brings Chicago’s sales tax to 10.25 percent. President Toni Preckwinkle’s proposed penny-on-the-dollar sales tax was approved by a vote of 9-7, with Commissioner Liz Doody Gorman casting a present vote.

Wednesday’s vote took place after a lengthy and sometimes heated debate and public hearing. Preckwinkle says in the absence of pension reform coming from Springfield, the county needs revenue from the sales tax to fund nearly $500 million in pension obligations next year.

But a serious issue has come up about the legality of using that tax for pensions. The issue was brought up by the Civic Federation's President Laurence Msall, who spoke against the tax hike on Wednesday.

“The county is going to need more money, right? The Civic Federation has supported the county’s proposal for pension reform, but I think it’s important to point out that pensions’ underfunding have been identified by the Civic Federation, by other groups for decades and it was less than two years ago that we finally had a proposal that came from this body that went to Springfield. All of us are frustrated by what’s going on in Springfield. All of us are impacted by the state’s inability to balance its budget,” Msall said.

He added, “We do not see how passing this sales tax increase now will even guarantee that the money goes into the pensions since there are real legal questions as to whether you can put money into the pensions except under state law from the property tax levy. For all of these reasons, the Civic Federation urges you to take the time to put your budget together for fiscal year 2016, and when it comes time to consider additional revenues, you do it within that structural budget so we can see that everything has been done possible to avoid the tax increase rather than being told.”

He added, “We do not see how passing this sales tax increase now will even guarantee that the money goes into the pensions since there are real legal questions as to whether you can put money into the pensions except under state law from the property tax levy. For all of these reasons, the Civic Federation urges you to take the time to put your budget together for fiscal year 2016, and when it comes time to consider additional revenues, you do it within that structural budget so we can see that everything has been done possible to avoid the tax increase rather than being told.”

There is a state law that specifies that public pension payments from a governmental agency need to follow a very specific formula using only property taxes. More than 40 years ago the City of Chicago apparently tried to use other revenue and ran into the same trouble, and the law was changed, but only for the City of Chicago.

As it stands today here is what the Illinois Code says about County pension payments:

“… the county shall levy a tax annually at a rate on the dollar of the value, as equalized or assessed by the Department of Revenue of all taxable property. . . The various sums to be contributed by the county board and allocated for the purposes of this Article…shall be taken from the revenue derived from this tax and no money of the county derived from any source other than the levy and collection of this tax.”

We have it on good authority that all of the Cook County Commissioners are well aware of this law or were at least made aware of it before Wednesday’s vote. But after the vote, both the county's corporation counsel and President Toni Preckwinkle expressed confidence that they could still move forward.

“Well it’s questionable if we need any additional legislative action. But what we know right now is there are other pension bills that are currently still in the courts, and we will be monitoring the legal as well as legislative landscape moving forward to see what additional authority we may have if that remains to be a question,” said Laura Lechowicz Felicione, Cook County corporation counsel.

“If Springfield acts on our pension reform legislation, I will reassess our revenue needs. But first we must have meaningful pension reform out of Springfield that meets those needs,” Preckwinkle said. “And as we talked to our commissioners over the last six weeks, explained to them the need for additional resources, there was not one commissioner who was in favor of raising property taxes. Not a single one. And we saw a path to getting nine votes for a sales tax, and so that’s what we pursued knowing that we needed the resources.”

The sales tax is estimated to generate around $470 million, which is what the county needs to fund its pensions next year. But there is still a lot that could happen before it goes up.

One possible outcome is a decision by a Cook County Circuit Court judge on the constitutionality of the city’s pension reform plan. That is scheduled to be issued on Friday, July 24. If the city’s pension reform plan is ruled unconstitutional, it could render the county’s proposal, which is similar, equally unconstitutional.

Based on that outcome Springfield may or may not take up the county's pension proposal in the coming months. But if all that fails, the county will start collecting the tax Jan. 1, 2016 and perhaps putting it in an escrow account until it receives a legal go ahead to use it toward pension payments.

Preckwinkle says she's open to repealing the tax increase or scaling it back if the county gets the pension reform it needs. But she also reserves the right to keep it.

Supporters and opponents of the proposed tax increase spoke before Wednesday’s vote. Watch some of their statements.

See how each of the commissioners voted.