Republicans and Democrats are at odds over what President Donald Trump’s planned overhaul of the tax code would mean.

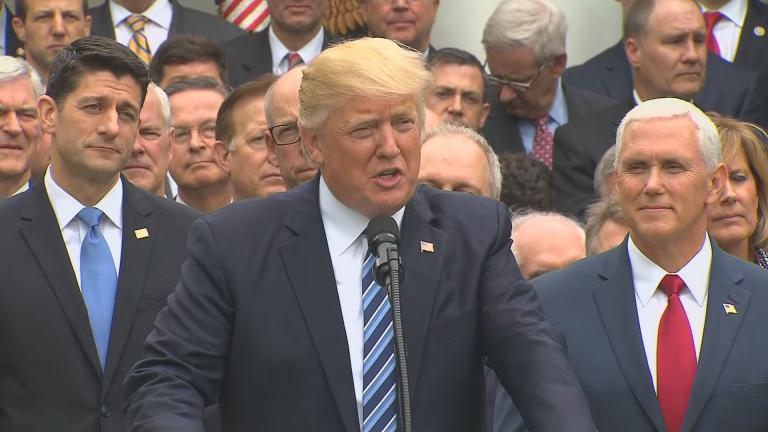

While Republican leaders like House Speaker Paul Ryan insist it will deliver tax cuts to many Americans in need, Democrats say it amounts to a giveaway for the very rich that will balloon the deficit.

The president said last week that the heart of his tax proposal “is a giant, beautiful, massive – the biggest ever in our country – tax cut.”

Diane Swonk, an economist and CEO and founder of DS Economics, says that while there is a need for radical reform of what has become an overcomplicated tax code, whatever changes are made need to be revenue neutral.

She draws a distinction between real “tax reform” that requires trade-offs and bipartisan compromise and “tax cuts” which, if not part of broader tax reform, are just “a sugar high.”

But Swonk says that at the moment there is simply not enough detail to evaluate Trump’s tax proposal.

“It’s much more of an outline than a plan,” says Swonk. “One of the problems that we’ve continuously come up against is that we are not getting a lot details and without details it’s hard to tell where the plans are going and what they’ll cost.”

But, she says, despite the sketchy details, independent and non-partisan groups that have attempted to analyze the plan think it will balloon the deficit.

Henrik Rasmussen, founder and president of investment consultancy firm Argonne Global, says tax cuts, particularly corporate tax cuts, need to come down to keep America competitive globally.

Trump has proposed reducing the top corporate tax rate from 35 percent to 20 percent.

“The U.S. currently has the highest corporate taxes in the industrialized world. I think it’s very, very important to make the United States more competitive in order to attract capital,” says Rasmussen. “I think this is all about American competitiveness in the global economy.”

He notes that the current corporate tax system “is deeply unfair to small businesses” because they make most of their earnings in America and therefore pay that corporate rate. But big multinationals can both afford to pay high-priced accountants to help them get their bill down and also hide profits abroad.

Rasmussen believes that tax cuts for both individuals and corporations will spur economic growth and generate extra tax revenue as a result.

“This isn’t about trying to divide the economic pie equally but trying to grow the pie so that there is more for everyone,” says Rasmussen.

“I think what you see with drastic tax cuts is obviously there is going to be an immediate deficit as a result, but over time, as we start to see businesses investing more and we start seeing the results of those investments in terms of a larger economy than you would have had otherwise – the tax cuts end up paying for themselves.”

But Swonk has her doubts.

“The more that they favor wealthy individuals and corporations the less they stimulate growth,” says Swonk. “They could stimulate productivity gains if they are done right on the corporate side, but the idea that they could not only pay for themselves but also be deficit reducing is a lie. There’s no evidence whatsoever of that.”

Rasmussen and Swonk join host Phil Ponce to discuss the president’s tax plan.

Related stories:

US Economy Grows, but Uncertainty Clouds Federal Reserve

US Economy Grows, but Uncertainty Clouds Federal Reserve

Sept. 12: Median incomes in America are on the rise. What will be the response of a Federal Reserve Board with vacancies?

Trump and GOP Take on Tax Policy After Health Care Flop

Trump and GOP Take on Tax Policy After Health Care Flop

Aug. 9: Will President Donald Trump and GOP lawmakers fare better on tax reform than health care?

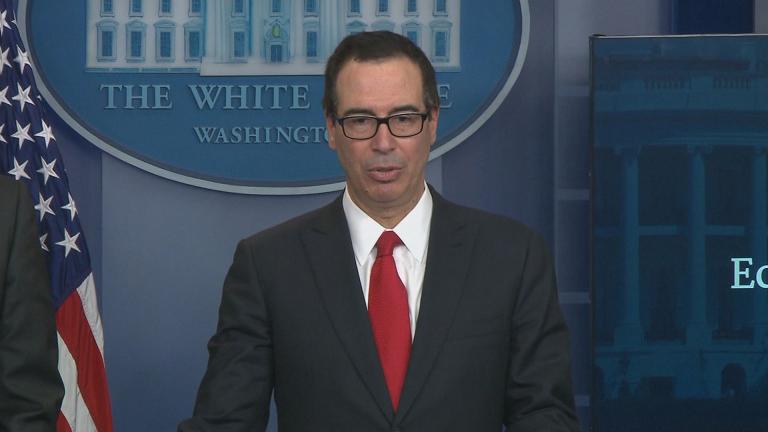

April 26: President Donald Trump’s tax plan was formally rolled out Wednesday. As promised on the campaign trail, the plan includes several business-friendly tax measures.

Unpacking Trump’s Tax Plan

Unpacking Trump’s Tax Plan