The recent GOP federal tax cut law isn’t very popular among Democratic politicians. But city officials are taking advantage of one provision that could jump-start development in blighted areas.

It’s called the Opportunity Zone Tax Credit and it was a little-talked about provision in that tax cut package that passed in 2017. It aims to spur investment in blighted areas by giving big tax incentives to those who decide to invest in low-income communities by allowing investors to defer capital gains taxes.

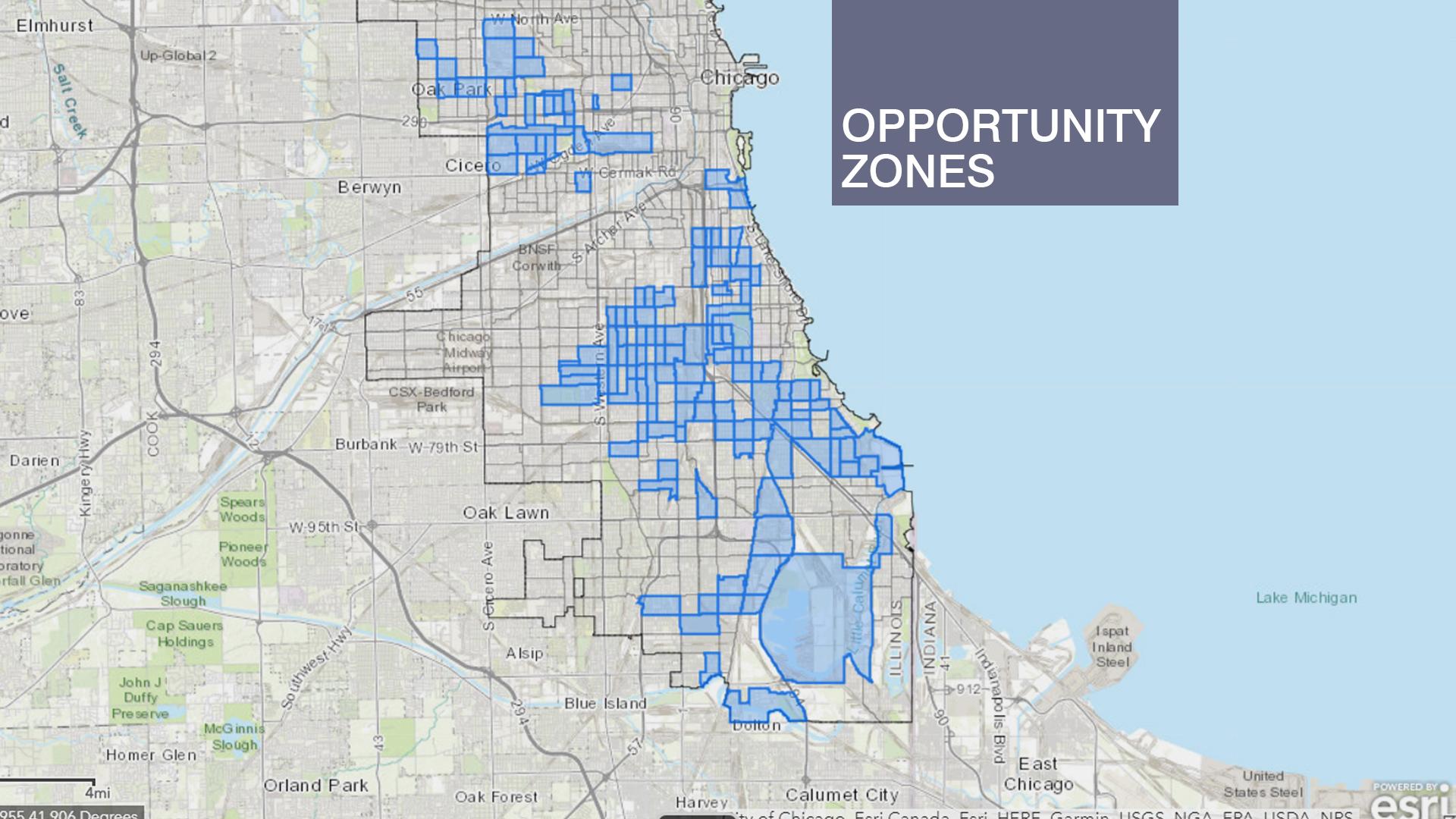

The city has to designate an area an “opportunity zone” and submit it to the state, which must in turn submit it to the federal government in order to be recognized. So far, Chicago has submitted 133 areas to the state for the designation, mostly across the South and West Sides, in places where the unemployment rate is over 20 percent, the median family income is less than $38,000, and the poverty rate is more than 30 percent.

City officials believe these areas fit the federal government’s criteria and investors may want to start building there to reap big tax benefits.

Chicago mayoral candidate Paul Vallas on Thursday highlighted the use of the tax credit as part of his economic plan, in conjunction with a few other proposals.

“If you take advantage of these tax credits and you combine them with existing resources, like the proper use of TIF money and effective sharing of TIF revenues with poor areas of the city, we can provide the type of financial infusion that can really help revitalize these areas,” Vallas said.

He also proposed a “buy Chicago hire Chicago” provision in which a larger portion of city contracting work goes toward those that hire Chicago laborers, and a redesign of the city colleges system that would move away from having each school focus on one trade. (Vallas says they should all offer the same core of trade programs to students.) Mayor Rahm Emanuel, however, looks at the City Colleges of Chicago system as a significant achievement, refashioning every school into a different vocation, such as health care services, logistics and transportation.

Vallas also suggested being able to move more TIF funds that are collected in wealthy areas to neighborhoods that need it the most – but that would require a change in state law.

There was other noise Thursday on the subject of TIFs. This time involving the massive Lincoln Yards project slated for an area between Lincoln Park and Bucktown on the North Side. The developer Sterling Bay has proposed a massive development that would include condos, office towers, music venues and a Metra station. And there is a TIF district proposed to assist in some of the infrastructure costs the city will have to foot to spur development. A coalition of community activists say they believe zero public dollars should go toward this project.

“The mayor’s proposed a new TIF district in this area, and we understand very clearly what that’s for, and that’s to take away public dollars and putting it in the hands of a wealthy developer instead of investing the resources in our communities,” said Amisha Patel of the Grassroots Collaborative.

The site is a prime contender for Amazon’s second headquarters should the city land it – which will require at least a $2.3 billion public subsidy package from city and state sources should Chicago win the bid.

Follow Paris Schutz on Twitter: @paschutz

Related stories:

Community Pushback to $5 Billion Lincoln Yards Proposal

$169 Million Industrial Complex Planned for Chicago’s Southeast Side

Former CPS CEO Paul Vallas Officially Announces Run for Mayor