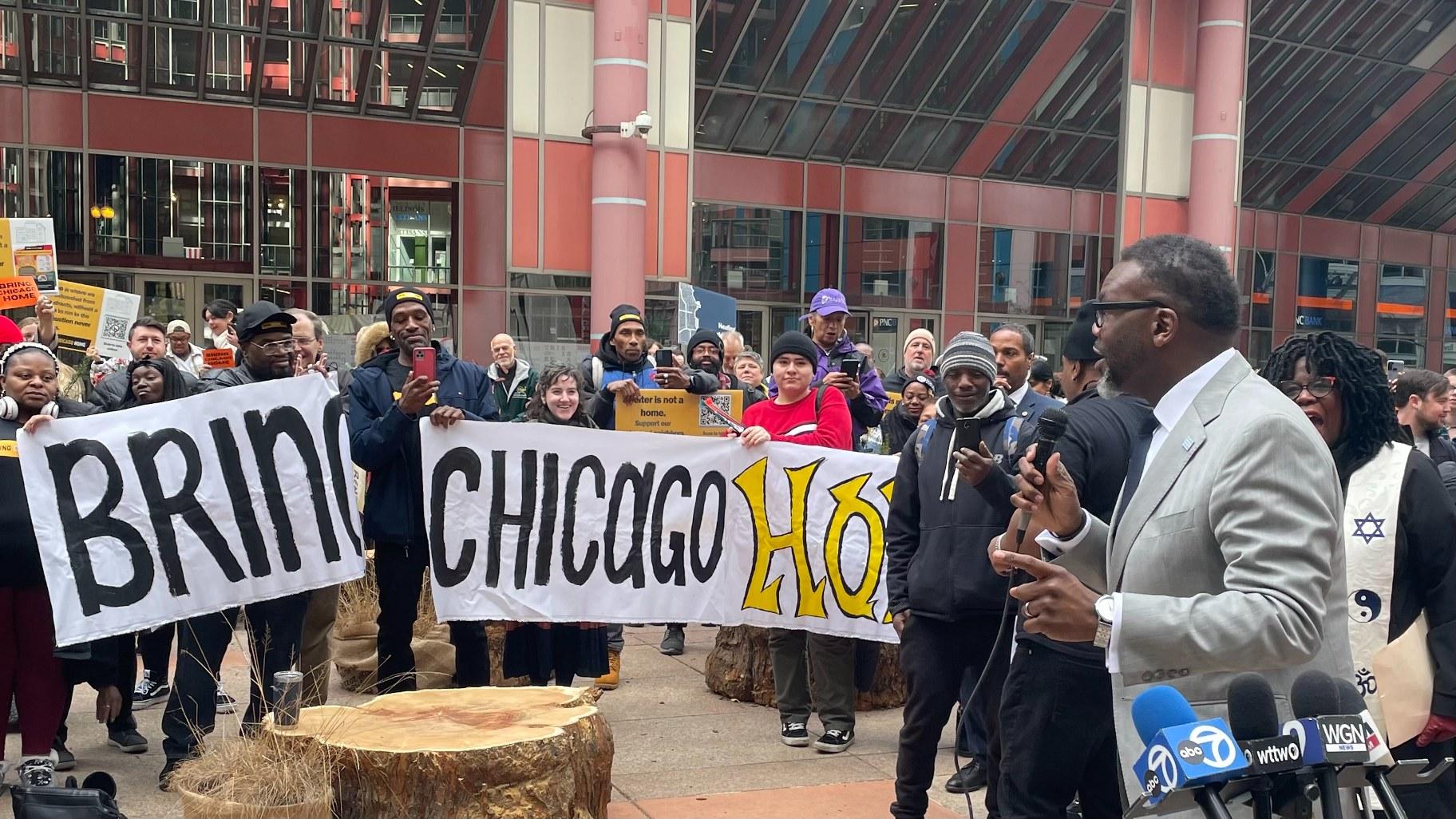

Mayor Brandon Johnson rallies supporters of the proposal known as Bring Chicago Home on Tuesday, Nov. 7, 2023. (Heather Cherone / WTTW News)

Mayor Brandon Johnson rallies supporters of the proposal known as Bring Chicago Home on Tuesday, Nov. 7, 2023. (Heather Cherone / WTTW News)

Chicago voters will be asked during the March 19 primary to give the Chicago City Council the power to hike taxes on the sales of properties worth $1 million or more to fight homelessness.

The Chicago City Council voted 32-17 to put the measure to voters next year. The last time Chicago voters passed a binding referendum that applied to the entire city was 1885, when they voted to create the Chicago Board of Election Commissioners, according to city records.

The vote by the City Council signals the start of what is sure to be a hard-fought battle, with business and real estate groups likely to spend tens of thousands of dollars in an attempt to convince voters the tax hike could cause the city’s already-struggling commercial real estate market to collapse amid the shift to remote work.

However, supporters of the proposal, known as Bring Chicago Home, said city officials have a moral obligation to house as many vulnerable Chicagoans as possible to confront the growing number of unhoused residents. Wealthy residents of Chicago should pay their fair share, officials said.

Before the vote, Johnson rallied with supporters across the street from City Hall, telling the assembled crowd Chicago would lead the way for the nation to address an escalating crisis of homelessness.

“We will prevail,” Johnson said, to loud cheers. “This is our moment.”

The proposal would slash the real estate transfer tax paid by Chicagoans who sell residential and commercial properties for less than $1 million by 20%, while hiking taxes on transactions of more than $1 million by as much as 400%.

That would generate approximately $100 million annually, which supporters say would be enough to address the root causes of homelessness by building new permanent housing that offers wraparound services like substance abuse counseling in an effort to combat crime and poverty throughout Chicago.

An August report from the Chicago Coalition of the Homeless, a member of the coalition that crafted the Bring Chicago Home proposal, found that the number of Chicagoans who do not have a permanent home grew 4% between 2020 and 2021, to 68,440 people.

State law does not give the City Council the power to change the transfer tax on its own authority. Without legislation passed by the General Assembly and signed by the governor, the measure needs the support of Chicago voters through a referendum before the City Council can levy the tax and collect the funds.

Under the current law, the buyer of a home worth $300,000 pays the same flat transfer tax as the buyer of a multimillion-dollar mansion or downtown skyscraper — a fact that supporters of the change contend is unfair and contributes to income inequality in Chicago.

The seller of a home sold for $500,000 now pays $3,750 in real estate transfer taxes, a 0.75% tax rate. If voters pass the binding referendum set to be on the March 2024 primary ballot, and the City Council agrees to levy the tax, that cost would drop to $3,000, or a 0.60% tax rate, officials said.

Nearly 94% of all properties sold in Chicago have a final purchase price of less than $1 million, officials said.

The transfer tax on properties sold for more than $1 million would spike by 233%, but apply to just to the amount of the sale greater than $1 million, in an effort to ensure the measure withstands a legal challenge and reduces the incentive for sellers to artificially lower sale prices, according to the proposal.

For example, the seller of a property that sells for $1.2 million now pays $9,000 in transfer taxes. Under the revised proposal, that would rise to $10,000, with the higher tax rate of 2% applied to just $200,000 of the sale price, according to the proposal.

Using the same mechanism, the transfer tax on properties sold for more than $1.5 million would spike by 400% with the increase only applying to the amount of the sale greater than $1.5 million, according to the proposal.

Imposing a marginal tax, rather than a flat tax, would make the tax fairer, and ease the tax burden on two- to six-unit properties, both residential and commercial, supporters said.

Contact Heather Cherone: @HeatherCherone | (773) 569-1863 | [email protected]