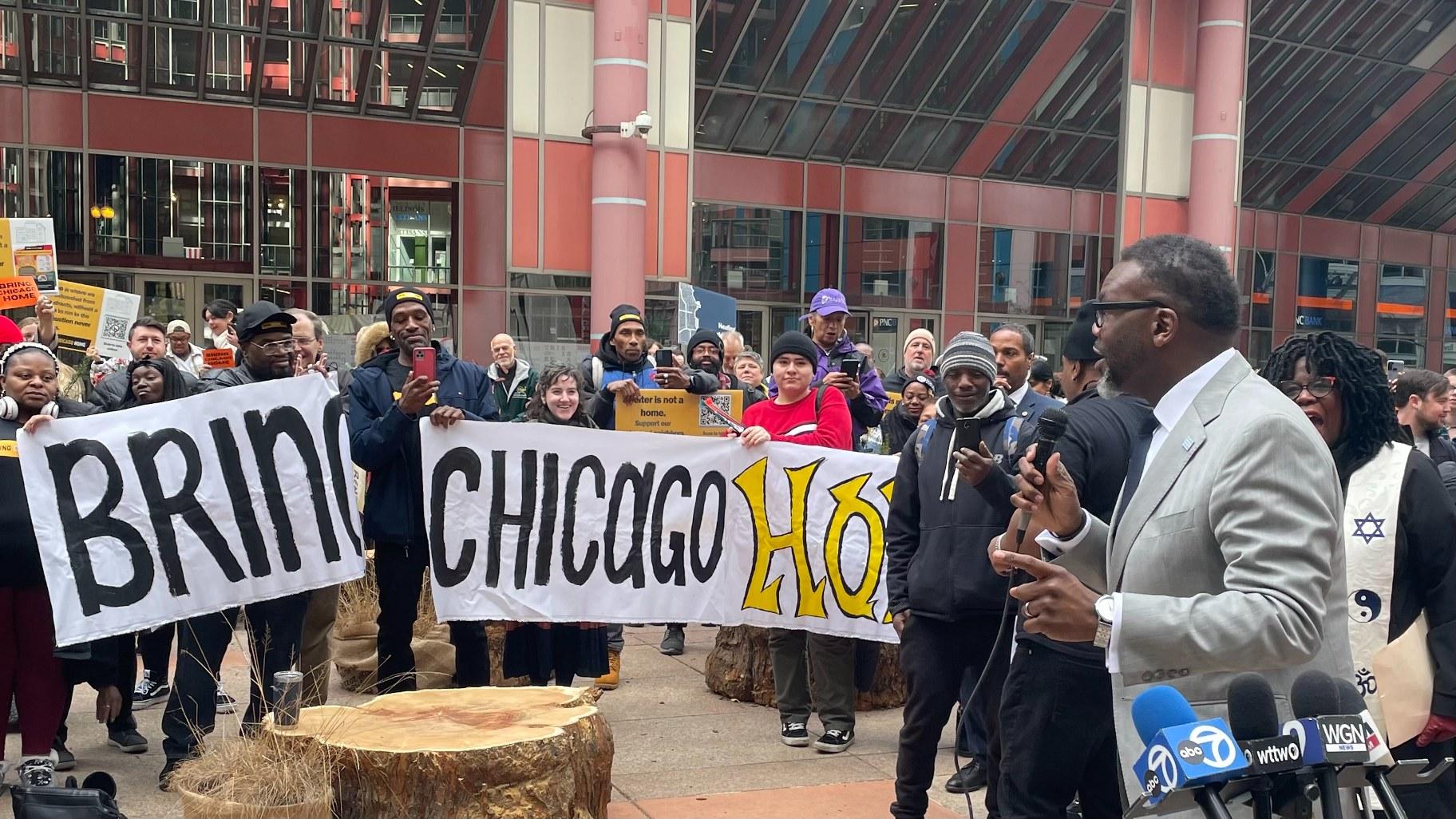

Mayor Brandon Johnson rallies supporters of the proposal known as Bring Chicago Home on Tuesday, Nov. 7, 2023. (Heather Cherone / WTTW News)

Mayor Brandon Johnson rallies supporters of the proposal known as Bring Chicago Home on Tuesday, Nov. 7, 2023. (Heather Cherone / WTTW News)

Chicago voters should get to decide during the March 19 primary whether to give the Chicago City Council the power to hike taxes on the sales of properties worth $1 million or more to fight homelessness, an appeals court ruled Wednesday.

Justice Raymond Mitchell, Justice Freddrenna Lyle and Justice David Navarro unanimously overturned the Feb. 23 decision by Cook County District Court Judge Kathleen Burke that had invalidated the binding ballot question known as Bring Chicago Home and ordered the Chicago Board of Election Commissioners not to count votes cast by Chicagoans.

Read the full decision by the panel of 1st District Appellate Court judges. Their decision could be appealed to the Illinois Supreme Court.

The opinion, written by Mitchell and joined by Lyle and Navarro, blasted Burke’s decision to side with the real estate and development groups that sued the Chicago Board of Election Commissioners to block the ballot measure. That lawsuit claimed the measure improperly asked voters to decide three issues, when state law limits ballot measures to only one question.

“The holding of an election for the purpose of passing a referendum to empower a municipality to adopt an ordinance is a step in the legislative process of the enactment of that ordinance,” the opinion said. “Courts do not, and cannot, interfere with the legislative process.”

Burke also erred when she prevented the city of Chicago from intervening in the lawsuit, the appeals court panel ruled, calling her rejection of the city’s application “an abuse of discretion.”

The justices said they were baffled by Burke’s decision not to detail the reasoning behind her ruling.

“Like the parties, we are left guessing as to the bases for the circuit court’s ruling because the lower court gave no reasons for its ruling,” the appeals court ruling said.

News of the ruling broke during an unrelated news conference held by Mayor Brandon Johnson, who appeared taken aback by the decision.

Johnson said he believed all along that the people of Chicago should decide how to address the growing number of unhoused Chicagoans.

“This has been a long time coming for the people of Chicago, where two other administrations were reticent or just, quite frankly, negligent,” Johnson said. “It’s a different day for Chicago. That’s a good thing.”

The author of the measure, Ald. Maria Hadden (49th Ward), said she was relieved.

Supporters of the ballot measure continued to campaign during the 12 days it languished in limbo, and vowed Wednesday to redouble their efforts.

“We look forward to keeping up our efforts to reach hundreds of thousands of voters about their opportunity to vote yes for a fair and sustainable plan to fund housing, care for the homeless, and ask wealthy real estate corporations to pay their fair share,” said Maxica Williams, chair of the End Homelessness Ballot Initiative Committee and president of the Chicago Coalition for the Homeless board.

The Building Owners and Managers Association of Chicago and other opponents warned that hiking the city’s Real Estate Transfer Tax could cause the city’s already-struggling commercial real estate market to collapse amid the shift to remote work.

Farzin Parang, the executive director of the Building Owners and Managers Association of Chicago, called the proposal “misleading and manipulative” and vowed to continue with ramped-up “efforts to educate the public about the negative impacts of this tax increase.”

Parang said the coalition of groups that brought the lawsuit plans to “review the order carefully and consider next steps.” The decision by the appellate court panel could be appealed to the Illinois Supreme Court.

The Chicago City Council voted 32-17 in November to put the measure to voters.

The last time Chicago voters passed a binding referendum that applied to the entire city was 1885, when they voted to create the Chicago Board of Election Commissioners, according to city records.

Johnson and other supporters of the proposal said city officials have a moral obligation to house as many vulnerable Chicagoans as possible to confront the growing number of unhoused residents while ensuring wealthy residents of Chicago pay their fair share.

The proposal would slash the real estate transfer tax paid by Chicagoans who sell residential and commercial properties for less than $1 million by 20%, while hiking taxes on transactions of more than $1 million by as much as 400%.

That would generate approximately $100 million annually, which supporters say would be enough to address the root causes of homelessness by building new permanent housing that offers wraparound services like substance abuse counseling in an effort to combat crime and poverty throughout Chicago.

An August report from the Chicago Coalition of the Homeless, a member of the coalition that crafted the Bring Chicago Home proposal, found that the number of Chicagoans who do not have a permanent home grew 4% between 2020 and 2021, to 68,440 people.

State law does not give the City Council the power to change the transfer tax on its own authority. Without legislation passed by the General Assembly and signed by the governor, the measure needs the support of Chicago voters through a referendum before the City Council can levy the tax and collect the funds.

Under the current law, the buyer of a home worth $300,000 pays the same flat transfer tax as the buyer of a multimillion-dollar mansion or downtown skyscraper — a fact that supporters of the change contend is unfair and contributes to income inequality in Chicago.

The seller of a home sold for $500,000 now pays $3,750 in real estate transfer taxes, a 0.75% tax rate. If voters were to pass the binding referendum on the primary ballot, and the City Council were to agree to levy the tax, that cost would drop to $3,000, or a 0.60% tax rate, officials said.

Nearly 94% of all properties sold in Chicago have a final purchase price of less than $1 million, officials said.

The transfer tax on properties sold for more than $1 million would spike by 233%, but apply to just the amount of the sale greater than $1 million, in an effort to ensure the measure withstands a legal challenge and reduces the incentive for sellers to artificially lower sale prices, according to the proposal.

For example, the seller of a property that sells for $1.2 million now pays $9,000 in transfer taxes. Under the revised proposal, that would rise to $10,000, with the higher tax rate of 2% applied to just $200,000 of the sale price, according to the proposal.

Using the same mechanism, the transfer tax on properties sold for more than $1.5 million would spike by 400% with the increase only applying to the amount of the sale greater than $1.5 million, according to the proposal.

Contact Heather Cherone: @HeatherCherone | (773) 569-1863 | [email protected]