Video: WTTW News Explains breaks down the Cook County property tax system.

For Cook County property owners eager to bite the bullet, the second installment of their 2022 property tax bill is available online now and headed to mailboxes early next month, officials said.

Property owners have until Dec. 1 to pay, once again later than usual amid continuing bureaucratic wrangling and finger pointing among Cook County officials.

But the delay is shorter than last year, when county officials scrambled to make sure bills were due before the end of the year, enabling them to deduct the payment from their taxes. In 2022, bills were not ready until late November, and in 2021 the bills were two months late.

The first installment of property tax bills was due April 3, giving property owners 242 days between due dates.

Typically, the first installment of property taxes is due March 1 and the second installment is due Aug. 1.

The delays began with the second installment of property tax bills in 2021, with Assessor Fritz Kaegi blaming the late bills on the Cook County Board of Review for not helping upgrade the assessor’s computer system. But Board of Review Member Larry Rogers Jr. said Kaegi was at fault for not using the old system, as well as the new system, to avoid delays.

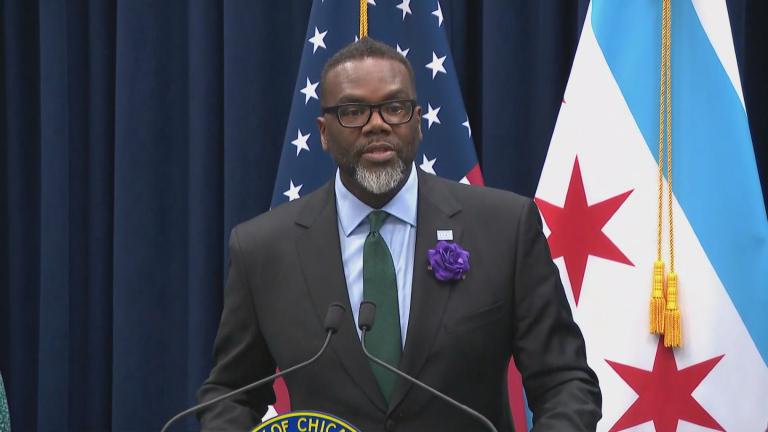

Mayor Brandon Johnson’s 2024 spending plan does not include a property tax hike to keep up with the rising rate of inflation, a year after property tax bills reflecting massive hikes triggered by the required reassessment of all Chicago properties.

Bills are available online at cookcountytreasurer.com and should hit mailboxes by Nov. 1.

Contact Heather Cherone: @HeatherCherone | (773) 569-1863 | [email protected]