Gov. Bruce Rauner made $91 million last year in state taxable income, much of that through capital gains.

It’s less than his 2015 income of $188 million, but it’s more than he was making before he became governor: Rauner made about $60 million in 2013, and $58.5 million in 2014, the year he was inaugurated and put his investments into a blind trust.

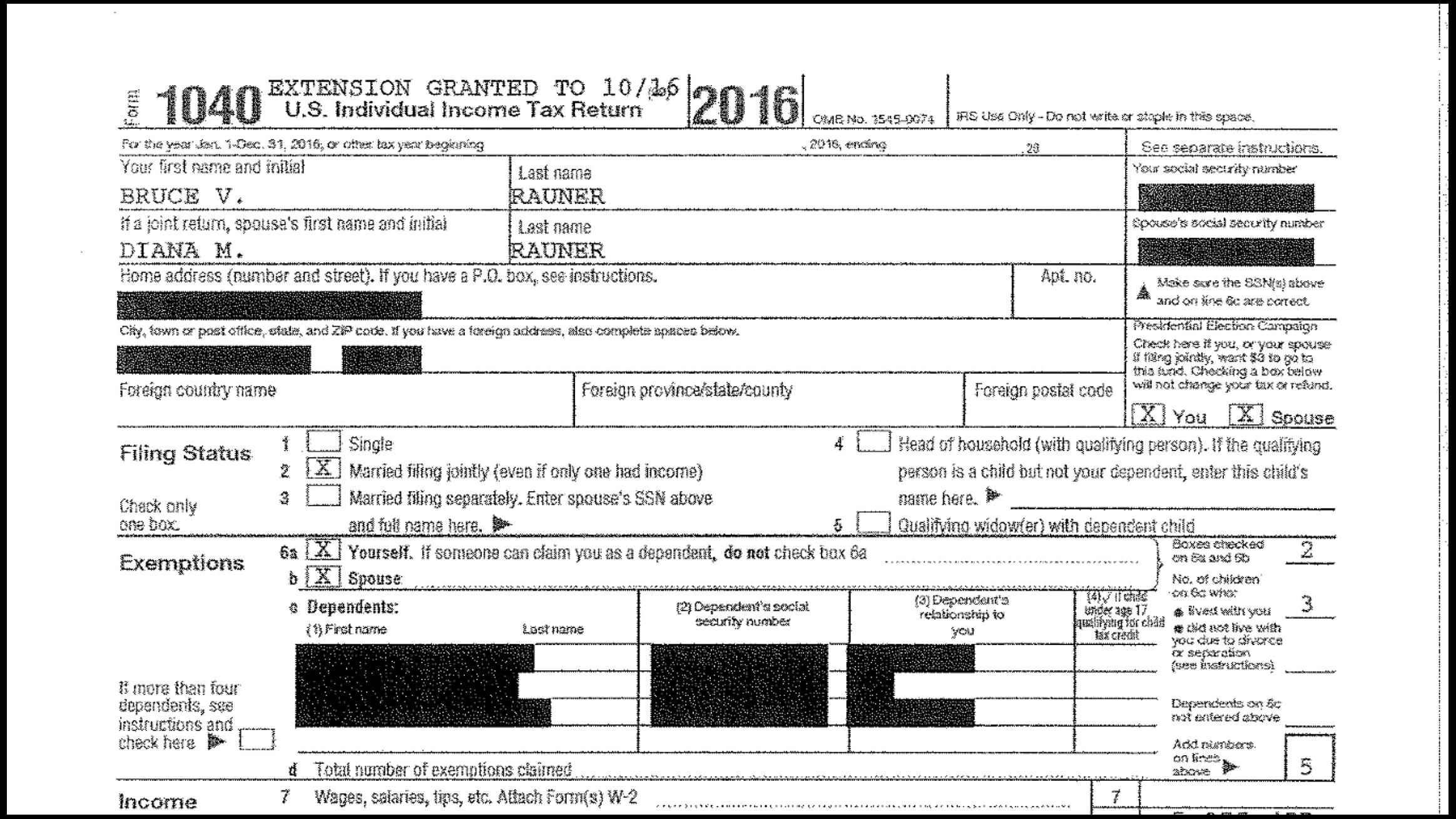

Document: Read the tax forms

The 1040 tax return forms Rauner released Tuesday show his effective tax rate was 26.6 percent, and that he, his wife, and their foundation gave $6.6 million to charity.

Document: Read the tax forms

The 1040 tax return forms Rauner released Tuesday show his effective tax rate was 26.6 percent, and that he, his wife, and their foundation gave $6.6 million to charity.

A list of specifying charities was not included.

Rauner, a Republican and a former private equity investor, is not taking a state salary.

Next year’s campaign for governor is on pace to break records; the Illinois Campaign for Political Reform reports that the last quarter of spending reports showed spending surpassed $15 million.

Rauner won his first bid for office in 2014 after pouring his personal wealth into his campaign fund, and $50 million of his campaign war chest comes from his personal bank account.

But he could be outspent this cycle.

Rauner doesn’t appear on the list Forbes published this week of the 400 richest people in the U.S. (though the $8.5 billion net worth of his top outside contributor, Ken Griffin of the Citadel hedge fund, means Griffin holds the title of the richest Illinois resident. Griffin comes in 36th on the national rankings).

One of his Democratic challengers – J.B. Pritzker, who has a new worth of $3.4 billion – is listed as the 219th richest in the U.S., and the fifth wealthiest in Illinois.

Pritzker has committed to taking no campaign contributions, and is solely self-funding his campaign.

Earlier Tuesday another contender in the Democratic primary, state Sen. Daniel Biss, D-Evanston, amped his continued pressure on opponents Pritzker and businessman Chris Kennedy, to release their tax returns.

Biss previously released five years of returns, and says he will make his 2017 forms public before the March primary. His 2016 forms show Biss and his wife had an adjusted gross income of $32,568 in 2016, with federal taxable income of $2,958 after deductions and exemptions.

“This election offers Democratic voters a choice about who they trust to fight for them: wealthy businessmen or a middle-class grassroots organizer with a record of progressive accomplishments. If we can’t trust JB Pritzker and Chris Kennedy to keep their word on something as simple and customary as releasing their tax returns, why should we trust their other campaign promises?” said Biss campaign manager Abby Witt in a statement.

Candidates are under no obligation to release their tax information, though it is customary. Forms help to discern potential conflicts of interest, fiscal management, as well as a candidate’s priorities through charitable giving.

Elected officials are obligated to file public economic interest statements, though watchdog groups have long criticized Illinois’ disclosure requirement and forms as weak and riddled with opportunities for loopholes.

Follow Amanda Vinicky on Twitter: @AmandaVinicky

Related stories:

2018 Illinois Governor’s Race: Who’s Ahead, Who’s Behind

2018 Illinois Governor’s Race: Who’s Ahead, Who’s Behind

Sept. 7: Political intrigue and high finance mark the race for governor.

What Does It Cost to Run for Governor in Illinois?

What Does It Cost to Run for Governor in Illinois?

July 18: Although the primary isn’t until March 2018, fundraising puts the governor’s race on pace to be one of the most expensive such races in the country’s history. It may even break that record.

Gov. Bruce Rauner Earned $188 Million in 2015

Gov. Bruce Rauner Earned $188 Million in 2015

Nov. 11, 2016: Last year Gov. Bruce Rauner made more than $188 million, according to documents released from his office Friday.