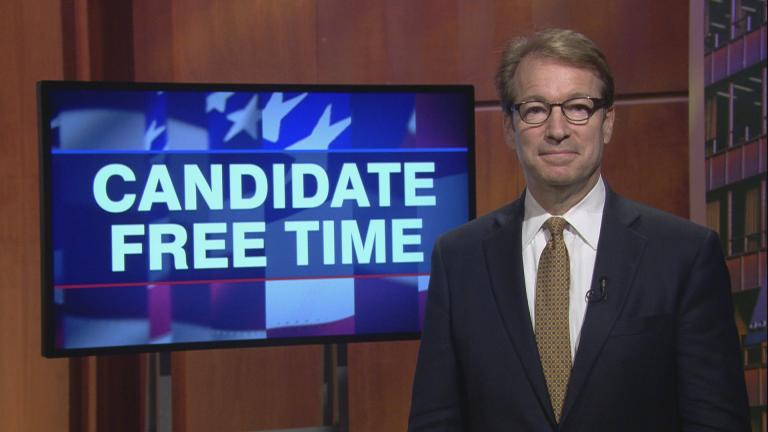

Illinois Republican Congressman Peter Roskam says that criticisms of the recently passed House GOP tax cut bill are “hyperbole.”

Since passage of the bill in the House and passage of a Senate version out of the Senate Finance Committee on Thursday, Democrats and some newspaper editorials have referred to the plan as a thinly veiled giveaway to rich corporations at the expense of lower- and middle-class earners. Roskam says he believes the public will support it once they learn what’s in it.

“What we’ve proposed is lowering these rates all along the spectrum,” he said Friday during an interview at his Barrington district office. “The criticisms are over-characterized and not particularly persuasive. And the fact is, if half the country says this is a good thing, and you continue the debate further, I think this gets better and better and better.”

The hallmark of both the House and Senate versions is a lowering of the corporate tax rate from 35 percent to 20 percent, and a break on companies who repatriate profits from overseas.

“We’ve got a structure that disadvantages American companies that compete on a global basis,” he said.

The economic benefit assumes that companies will use the savings to invest in capital, new jobs and higher wages for employees, despite anecdotal evidence that shows they may be more prone to spend the money on debt payments, stock buybacks and mergers. The bill also adds $1.5 trillion to the nation’s deficit over the next 10 years, but proponents are counting on 3 percent annual GDP growth to offset that. Roskam acknowledges that growth rate is not a sure thing.

“There’s no way somebody can say declaratively, this is gonna happen. But here’s what I know: staying here is a disaster. This is a tax code that is dissolving underneath us. If we stay here, more and more companies will leave the United States and be acquired by foreign companies.”

Watch the full interview below.

He also acknowledges that most big corporations don’t pay the 35-percent rate, with many not paying any income tax at all. The current, antiquated tax code is to blame, he says.

“It is the status quo that has allowed companies not to pay taxes. So let’s change that,” he said. “Everybody tries to minimize their tax burden, so the question is, how do you do that in a way that’s fair and reasonable and not capricious. Creating this lower rate, we’re saying we want the U.S. to be the best jurisdiction in the world to invest. We want to attract foreign investment.”

And he likens the short-term debt that the tax cuts create to a business borrowing money for a down payment on an investment that pays future dividends.

“There’s nobody in their right mind cavalier about debt, particularly in this environment. We use debt as a tool. If you borrow something to buy something that’s appreciating, that’s a smart move. Taking on this debt is the best way to grow our economy. You get a tax code that is built for the future. That’s worth an acquisition cost. And you get the growth that comes out of this,” he said.

The Senate bill calls for the expiration of individual tax cuts by 2026. An analysis by the Congressional Joint Committee on Taxation found that earners who make less than $30,000 would pay higher taxes in 2021, and those under $75,000 would pay higher taxes in 2026. The corporate rate cut would be permanent. The Senate version also does away with the tax break for state and local income taxes, and property taxes, which could cause tax increases for tens of thousands of families in relatively high-tax states like Illinois. The House bill includes a $10,000 property tax deduction, and he says that any effort to get rid of that in the Senate would be a non-starter during the reconciliation process, where the chambers try to merge their two bills. He also says he hopes the Senate reconsiders tax increases on lower earners.

The passage comes at a time of political peril for Roskam, whose 6th Congressional District was just moved into the “toss-up” category by the Cook Political Report. A number of Democrats have declared their candidacy to challenge him, with backing by the grassroots group Indivisible. Roskam says he is proud to run on the benefits of the tax bill.

Follow Paris Schutz on Twitter: @paschutz

Note: This story was originally published Nov. 17.

Related stories:

Paradise Papers Offer Insight into Strategies to Minimize Tax Burden

Paradise Papers Offer Insight into Strategies to Minimize Tax Burden

Nov. 14: Bermuda is more than a lovely vacation destination. Apparently, it’s also one of the places very wealthy people—and companies—stash their cash to lower their taxes.

Tax Overhaul, New Fed Policy Could Chart New Course for U.S. Economy

Tax Overhaul, New Fed Policy Could Chart New Course for U.S. Economy

Nov. 7: Tempers flare in Congress as House Republicans move quickly to overhaul the nation’s tax system. A look at the economic politics and policies at play.

House Republicans Delay Tax Overhaul Reveal

House Republicans Delay Tax Overhaul Reveal

Nov. 1: GOP lawmakers delay releasing their tax overhaul. Can legislators agree on cuts that meet the president’s demands?