A plan to enact higher taxes on the sales of expensive real estate in Chicago is swiftly moving forward.

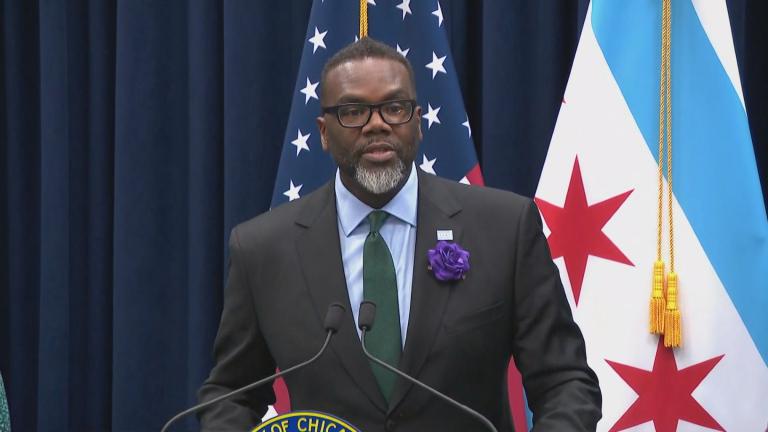

Mayor Brandon Johnson recently announced a new proposal dubbed “Bring Chicago Home,” which would raise about $100 million dollars to fight homelessness by raising taxes on all sales above $1 million, and then an additional hike on sales of more than $1.5 million dollars.

The proposal would also slash the transfer tax on real estate that sells below $1 million.

Joining “Chicago Tonight” to discuss the proposal are Farzin Parang, executive director of the Building Owners and Managers Association of Chicago, and Ald. Carlos Ramirez Rosa, chair of the Zoning Committee and the mayor’s floor leader.

Read more on the proposal here.

Under the current law, the buyer of a home worth $300,000 pays the same flat transfer tax as the buyer of a multimillion-dollar mansion or downtown skyscraper.

The seller of a home sold for $500,000 now pays $3,750 in real estate transfer taxes, a 0.75% tax rate. If voters pass the binding referendum set to be on the March 2024 primary ballot, and the City Council agrees to levy the tax, that cost would drop to $3,000, or a 0.60% tax rate, officials said.

The transfer tax on properties sold for more than $1 million would spike by 233% percent, but apply to just to the amount of the sale greater than $1 million.

For example, the seller of a property that sells for $1.2 million now pays $9,000 in transfer taxes. Under the current proposal, that would rise to $10,000, with the higher tax rate of 2% applied to just $200,000 of the sale price.

Using the same mechanism, the transfer tax on properties sold for more than $1.5 million would spike by 400% with the increase only applying to the amount of the sale greater than $1.5 million.

WTTW News reporter Heather Cherone contributed.