The median homeowners in Cook County’s north and northwest suburbs saw their property tax bills rise 15.7% this year, according to a new study just released from Cook County Treasurer Maria Pappas’ office.

The study concludes that it’s the largest residential property tax hike for that part of the county in 30 years. The study also shows the tax burden shifting from commercial properties to residential properties, despite Cook County Assessor Fritz Kaegi’s initial campaign promises to shift things in the other direction.

The North Shore suburbs saw modest increases in their residential property taxes, but some of the blue-collar northwest communities were socked the hardest.

Rosemont saw the largest increase at 32%, although residential properties in that community are typically rebated a large portion of that sum due to the revenue that comes from business, entertainment and convention taxes.

The towns with the next highest increases were Schiller Park at 29.7% and Des Plaines at 28.7%. Some homeowners in these communities saw their taxes more than double from the year prior, much of it due to higher assessed property values.

The Cook County assessor recently completed its reassessment of the value of properties in the north and northwest portion of the county, which is factored into this year’s property tax bills there. The higher assessed values are more pronounced given that the assessor’s office reduced them during the pandemic. Approximately one third of all properties in the county are reassessed each year. The city of Chicago’s assessment was completed in 2021. The south and southwest suburbs will be completed this year, with new values expected to be reflected in next year’s property tax bills.

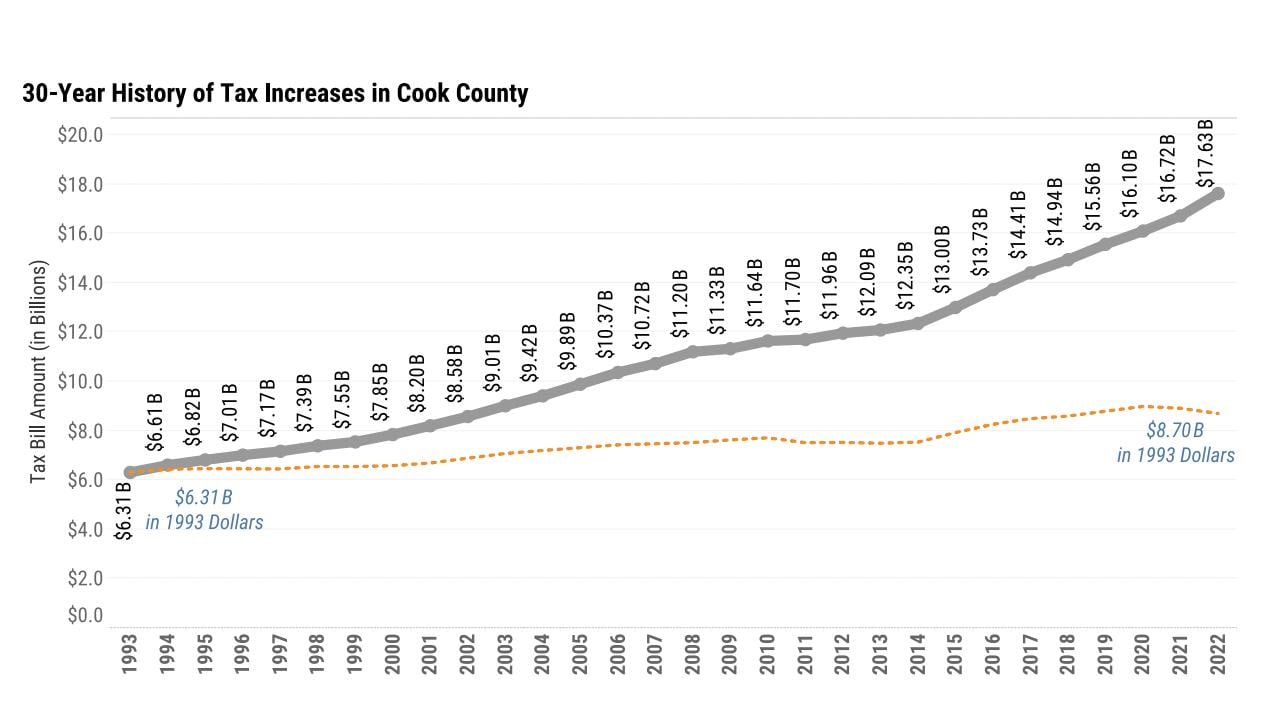

All told, total property taxes across the county rose 5.4% last year from $16.7 billion to $17.6 billion.

An examination of the treasurer’s data shows that school districts are also driving a significant part of the increase. Nearly all county school districts have increased their levy — or the total taxable amount requested to cover expenses.

Property tax increases in Cook County over a 30 year period. (Credit: Cook County Treasurer's Office)

State law requires school districts to cap their yearly levy increase at 5% or the rate of inflation, whichever is less. But the study says many of those districts took in additional money thanks to a new state law that allows them to recapture money that was refunded to property owners after getting their bill reduced by the Illinois Property Tax Appeal Board.

Property tax increases in Cook County over a 30 year period. (Credit: Cook County Treasurer's Office)

State law requires school districts to cap their yearly levy increase at 5% or the rate of inflation, whichever is less. But the study says many of those districts took in additional money thanks to a new state law that allows them to recapture money that was refunded to property owners after getting their bill reduced by the Illinois Property Tax Appeal Board.

“The lesson here is to check your tax bill and pay attention,” said Pappas, who tasked former Chicago Tribune reporters Hal Dardick and Todd Lighty, now analysts in her office, with completing the study.

In a written statement, the Cook County Assessor’s Office attributed the increased assessed values to a hot real estate market that has led to higher home prices and new construction.

The statement also says that the office’s initial reassessment resulted in a 30% hike for residential properties and a 38% hike for non-residential properties (i.e., commercial and industrial). But the statement indicates that commercial property owners were far more successful in having their new assessments appealed and lowered by the Cook County Board of Review, a government agency made up of three elected commissioners, which shifted the lion’s share of the burden.

“As a result of the Board of Review’s work, the final growth in North Suburban assessments was 28% for residential properties and 11% for non-residential properties,” the assessor’s statement read. “Because growth in residential properties outpaced non-residential assessed values, this shifted who pays what share of property taxes.”

The treasurer’s study shows that the median residential property tax bill in Chicago rose 3%, while the median bill in the south and southwest suburbs rose 3.9%.

Cook County property owners should receive their second installment tax bill sometime in November with a due date of Dec. 1.

Note: This article was updated to remove a reference to specific school district numbers. The article was first published Oct. 30 and updated with video Oct. 31.

Follow Paris Schutz: @paschutz